How much time do you spend looking for profitable strategies on the internet?

After countless videos like “Strategy to make $5k a day!1!!” showing twelve indicators per chart, that perfect strategy has not come yet.

Thousands of attempts, trying to find it far in the outside world, while it was most likely closer to us than how we could ever expect.

No worries at all: the time has come.

As determined traders, provided with a strong desire towards our success, we now explore the realms of trading strategies and spy on the foundations to see what is really underneath a perfect strategy, and why it is so difficult to obtain it.

Let’s break down the concept of strategy, then how to truly get a perfect one to improve our trading.

What does the market think about your strategy?

The market is very intelligent and magnanimous. It gives infinite opportunities and it lets itself be observed through any lens and translated into infinite ways.

However, there are only three things it demands so far:

Discipline, Knowledge, and Self-Control.

This means — It wants you to be a better human. Acknowledging this is the very first achievement.

So, what does the market think about your strategy?

Here’s the perfect answer —the market doesn’t give a damn about your strategy.

If a trader misses the first requirements, no strategy is going to be profitable for him. The best one still would be useless.

This is how great and powerful are the principles behind the market: they are much more powerful than any strategy you can come up with.

The best strategies make no money in the hands of unworthy users.

What truly is a strategy?

Let’s remember that everything needs to be crystal-clear. The correct understanding of those things that appear to be simple is often undervalued and taken for granted.

A strategy is just a way to translate the market in your favor. There are infinite efficient strategies because there are infinite ways to translate the market, but its content is always one, no matter how you put it.

Fortunately, the mind has its ways of understanding reality through observation over time; it does not initially need any additional language, it just needs experimenting.

When you will have truly grasped the principles and the dynamics of the market, which are the things that make its content, you can use whatever strategy, i.e any translation of that same content.

Having a strategy doesn’t mean using indicators; it means having an efficient understanding of the market.

Indicators are tools.

They are like vocabularies — very useful, but one could also learn a language without them.

Every child who learns human language and speaking needs no vocabulary but just experience, attentive observation, and curious listening. The child is provided from the very nature of the mind with the capability of perception and association.

The market is based on the same principle: first, it comes its intrinsic understanding, then it comes the tool.

One could trade with a completely naked chart and still be profitable, de facto needing no indicators. This is how special the market is.

Building your own strategy vs taking it from someone else

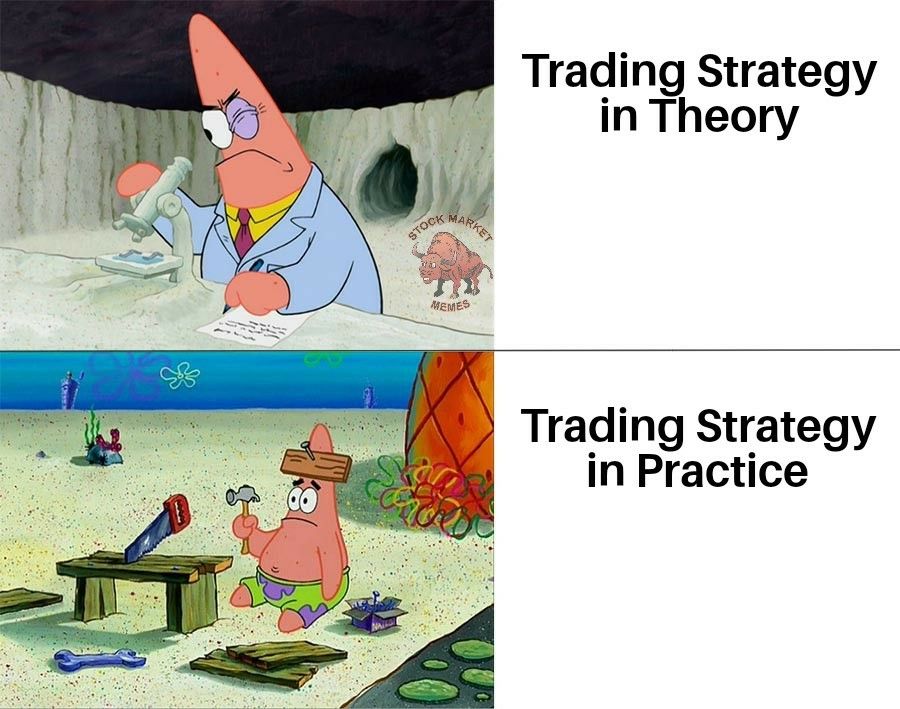

Contrary to common thinking, It is way easier to build your own strategy from scratch versus taking it from someone else and being efficient still.

The reason is that as we stated before, the market firstly tests your personality and your human nature. The first one is always different, the second is always the same, especially about weaknesses.

A strategy is specifically meant to overcome those human weaknesses, but it is incredibly difficult to find something pre-assembled that fits with your personality because you are unique in that.

Imagine having to test thousands of strategies until you get the one that seems to fit best for you, and still, it won’t perfectly — it will never be as much as the one that you would develop for yourself.

Indeed, what if YOU build the perfect strategy for you?

You are the one who only knows what fits best with your uniqueness. While the majority spends time passively searching for a pre-assembled strategy scrolling the catalog, you could utilize that time to actively build it around yourself, with the result of having optimal, perfect-fitted efficiency and a lot more experience than those who instead want to be spoon-fed.

You will waste a lot more time searching for the blessing that casually drops on your hands. Rather build your own blessing with what’s inside your head.

How to build your own strategy?

The best strategy you can find is developed by you and yourself only. The best traders have their own strategy.

In this point of view, being a trader is somehow like being an artist. The best artists are those who have understood Art and they have made their own interpretation of it.

You will never find a true Artist that became successful by being a clone. But it is also true that all Artists have tried to copy the grandmasters.

Becoming a successful trader follows the same steps.

Learning FROM the strategies and mindset of the grandmasters, then developing a UNIQUE strategy, which represents a personal interpretation/translation of the same, universal concept.

Are you still convinced that you want to learn someone else’s strategy? It’s your will but first consider: all strategies are never perfect for you at the beginning. At the same time, all strategies can eventually become perfect for you, but only when you’ve completely understood them and, most importantly, ADAPTED YOURSELF to them. Because trading implies your whole self, to be profitable with someone else’s strategy you must learn to

change your whole self to fit the attributes that that strategy requires. If you really want to make something like this, let it be because it would turn you into a better person.

Four practical steps to develop your strategy

1. Accumulate screen time

Experience is all about living in the first person. A child will not learn any languages if he is not exposed to them.

Learn on the field: let your mind get used to the market and let it store information.

Don’t waste time talking or scrolling useless opinions and news. Use your time for your best — accumulate experience.

2. Individuate the dynamics of the market that fits with your unique way of analysis

The more screen time, i.e. experience of perception and association that you accumulate from the market, the more you develop an intrinsic understanding of it. Your mind will naturally develop it by unconsciously concentrating on those characteristics that it is more predisposed to individuate.

That predisposition is the source of your uniqueness, and likewise, it is for your strategy. Your role is to reach a point where you can consciously recognize those market characteristics.

3. Use indicators as boosters of your way of analysis

Indicators are tools. Their role is to enhance the way you approach analysis and help you boost it up.

They are like computers: these help men in the tasks they already know how to handle, they’re just quicker and more precise. Simply put, they’re powerful instruments.

If you want, you can use those indicators to serve you in your way of perceiving the market by enhancing those characteristics that your mind already uses by itself to analyze it.

4. Consider the differences between the market environments

Depending on which type of environment you majorly accumulated your screen time on, your mind may have stored peculiarities that relate to that specific one, which does not necessarily apply to others.

If it’s true that the base principles are the same, it is also needed to take into consideration the differences that define each branch of the market.

Because of this, if your trading covers multiple of them, you may want to establish a core strategy, therefore add on top of it the specific requirements and adaptations for each branch.

In conclusion

Finding the perfect strategy is a goal that all traders aspire to reach.

Unfortunately, the common attitude is to search for it from someone else, having the illusion that it would be the fastest and more secure way to achieve the goal.

The market is such perfectly created that it doesn’t reward any shortcuts. It welcomes unworthiness, but it doesn’t recompense it.

This principle is so powerful that even the best of the strategies will not be profitable when used by someone who doesn’t belong to its supposed profitability.

The process of building your own strategy not only guarantees you a method that fits perfectly with yourself but also gives you the right to be rewarded for your commitment and for the experience you gained.

Everything described in this article has the sole purpose of being informative and providing general information. The author has no intention of providing any financial advice, legal advice, or tax advice. Do not rely on this article to make investment decisions. Seek professional help before making any such decision. The author does not take any responsibility for loss or damage of any nature. The use you make of the information contained in this article is your sole responsibility.