How many of us have the strong desire to be successful traders in the fastest way possible?

Profits and gratifications are so appealing that we dedicate our lives to the pursuit of our trading goals.

But are we really making the most of the hours we are sacrificing?

Just trading is not enough to make the experience:

We have to learn EFFECTIVELY from each one of the trades we make.

In this article, we will discover how to approach the results of a trade to make it truly educative and get better at trading as fast as we can.

Understanding Your Situation

Are you really learning while trading?

Before going any further, it is firstly needed to identify one’s habit to learn from what he does.

A lot of traders, especially those who have transformed trading into an addiction, never analyze the results of their movements and solely focus on making profits. This attitude is very counterproductive: they neglect the learning process and fail to develop a solid and effective experience.

This is largely caused by an unconscious conviction to profit by dint of “commitment”, without paying attention to the quality of the activity.

Unfortunately, the market doesn’t care about commitment and dedication. In fact, steady fallacious trading is going to cost a lot in terms of time and capital.

To know if you’re truly learning from your trading, firstly ask yourself these questions:

• How long have I been stuck here at this level of competence?

• When was the last time I learned anything from my own trading?

• Do I make the same mistakes over and over?

Try to concentrate on them and be very honest with yourself.

In the case of an unpleasant realization, accepting that there hasn’t been any recent improvement will help you in the evaluation of your situation. Moreover, by willing to find objective answers, you take the first step towards the redirection of your rudder.

Distinguishing healthy losses from bad losses

Be careful when you try to identify episodes that should define the situation of your learning process.

Every good trader knows that losses are part of the game. Some of them are healthy, but others are completely unjustified and avoidable. In analyzing your situation, consider the firsts as proof of discipline, and the seconds as signs that a necessary improvement is needed.

Losses are healthy when they come from a disciplined attitude and precise set of actions, included in a powerful strategy and originated from a self-controlled trader.

For example, when a position hits a stop-loss, which was conscientiously calculated through the strategy rules, the outcome can be called a healthy loss.

Losses are bad when they come from an undisciplined attitude, unsound strategy, unbalanced emotional state, lack of knowledge, gambler instinct, or reiterations of mistakes.

Both of the kinds are essential because they contribute to the success of the trader; While the bad losses help the trader in his learning process, healthy losses represent a natural occurrence that assists the trader in the growth of his capital.

The successful trader knows that his learning process has been very efficient when his losses are exclusively healthy.

If you still suffer from bad losses, you may want to enhance your focus on learning from your trades.

Do you want to trade or do you want to make profits?

A lot of traders just like to trade, some don’t even mind learning anything.

But when the goal is to make profits, traders need to separate their trading passion from their actual productivity.

Analyze your situation by trying to understand which of the two represents your true purpose.

If you just have fun trading and you don’t care much about making profits or losses, because you’re already wealthy or whatever reason, you are at least true with yourself and there is no discrepancy in your attitude.

If you want to make profits but you see no realized gains despite committing a lot, you’re probably not learning from your trades, resulting in being stuck into the same level for too long.

To transform the outcome into making profits, it is firstly needed to perfect the activity, otherwise, you’re just making something wrong over and over in hope of getting something positive.

You’re missing a truly profitable strategy?

Read How To Find The Perfect Trading Strategy.

5 Steps Guide To Efficiently Learn From Your Trades

Once you clarified what is your approach to the learning process and the inclination of your trading, you can directly jump into analyzing how to learn efficiently from your trades.

It is important to specify that one has to learn from both MISTAKES and SUCCESSES, to avoid repeating mistakes on one side, and to keep succeeding in the other.

These are 5 steps that serve as a powerful reference to make the most out of every trade.

Step 1: Identify the potential for learning and act ASAP

When you incur a relevant loss or profit, or more simply you make a trade that shows a spark of learning potential, be quick in identifying its magnitude and act accordingly.

It is VERY IMPORTANT that you take advantage of the moment as long as the experience is fresh.

By identifying the potential quickly, you can start your learning process with a clear image of what happened and a rich number of particulars to remember. In this way, it would be easier for you to impress the event in your mind.

Delaying this step will cost you a major number of events of the same type to truly grasp the concept, but if you rapidly act as the thing happens, it will save you A LOT of time in the future.

Step 2: Transcribe the experience

Take note of what you did and how. Write down the mistake or the element of success that you firstly identified, then develop a clear image of the situation around it.

Be focused on providing the highest number of details into your notes: describe the type of trade, the market environment, the general and personal sentiment, make screenshots of the charts, indicate your emotional state, mention news or any external factors, evaluate the risk taken, etc.

Being precise and explicit will be crucial for your future self, therefore make sure nothing will be misinterpreted or confused.

Moreover, while you’re transcribing, your mind re-elaborates the event and you simultaneously CATCH & LEARN more about the experience you lived.

Step 3: Reach a conclusion

After having described and analyzed what you needed to, summarize everything with one CLEAR and STRAIGHT-FORWARD sentence which perfectly explains the solution you managed to find.

This sentence is what you’re going to read in the future when you will need a reminder of the experience and what you learned from it.

By applying this step constantly, you will eventually end up with a lot of conclusions that you have accumulated, and that will be incredibly helpful throughout your trading career.

Here’s an amazing idea: group them into a list of utmost rules that will define your trading and will represent the pillars of your experience and knowledge.

Step 4: Fix the conclusion in your mind

By completing the previous steps, you helped your mind absorb the information and transform it into a TEMPORARY idea. It occupies a slot in your mind, but it will evaporate once enough time has passed.

It is needed to transform that TEMPORARY idea into a FIXED idea.

Think of your mind as a container of ideas. Your fixed ideas are the ones that are going to influence your way of thinking and acting the most. Truly learning something means transforming a volatile memory into a fixed idea.

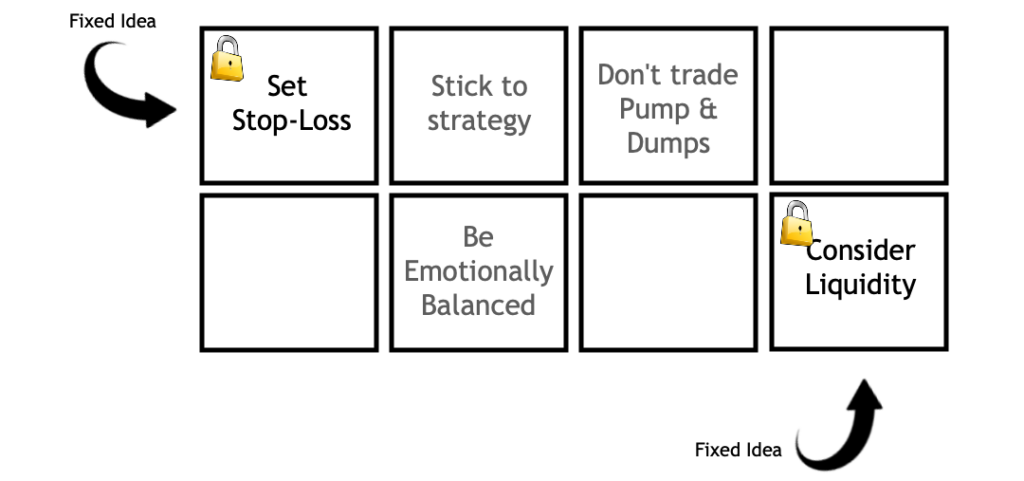

Let’s suppose you want to transform “Stick to strategy” “Don’t trade Pump&Dumps” and “Be emotionally balanced”, which are temporary, into fixed ideas.

There are two ways an idea can be fixed:

• By the impact of the source-event on yourself

• By repetitions of the concept

If the event already had a great impact on yourself, for example for being a great loss or profit, you’re halfway.

By repeating to yourself the concept over and over, you eventually fix the idea into your mind and it will take place into your unconscious trading attitude.

Step 5: Apply what you learned

Finally, concrete results can be obtained once everything is applied to reality.

As it was important to immediately act at first, it is equally important to proceed with your brand new knowledge from the very next trade you make.

As you approach trading subsequently, keep in your mind everything you learned and see the results of your labor.

You will be amazed at how much improvement you made by learning from your own movements.

As always: mere knowledge is never useful if not applied to the world. Ideas are not enough until they become reality.

In conclusion

The process of building a direct experience is incredibly undervalued. Too many people focus on getting tips and tricks from others, or even receiving trading secrets.

Here’s a secret: be your best teacher.

Learning from your own trades is not only a powerful method to get better at trading, it is also a way to enhance self-taught capabilities.

A trader can be full of knowledge, yet make continuously foolish decisions because he did not properly learn in the field.

Making mistakes is not going to teach anything unless mistakes are analyzed and understood and there is a strong will to not repeat them.

This article wants to provide a way to use mistakes to bring positive outcomes and to let successes be repeated in the future.

Everything described in this article has the sole purpose of being informative and providing general information. The author has no intention of providing any financial advice, legal advice, or tax advice. Do not rely on this article to make investment decisions. Seek professional help before making any such decision. The author does not take any responsibility for loss or damage of any nature. The use you make of the information contained in this article is your sole responsibility.