A change of perspective is often required in life. When something is going unfruitful, or a particular set of opinions and beliefs do not work, when we struggle to communicate with someone: a change of perspective is what can save our day or often our life.

You wouldn’t discern trading from life; if you look closely, they describe each other to the last detail. A harmful perspective can dismantle everything, from knowledge and experience to the psyche. Anyone could be an incredible living being, creator, person, human, trader, etc. if he had a good perspective.

Fortunately, a good perspective can save, bring to life the talents and virtues of a living being, help him succeed in everything, and set him free from his cages.

When a trader can’t get rid of his unsuccessfulness, when he seems lost in unprofitability and despair, it is most likely because of his single trade perspective. His mind works in a disharmonic trade-by-trade process, with a tiny little picture showing one and only one event, the single trade itself.

In this article, we will enhance the strengths of a series of trades perspective and how it can change your mind, then your trading.

Reducing the impact of a single trade on your psyche

No life and death perspective

Having a life and death perspective means attributing to a particular event or action extreme importance.

This perspective gives two possible outcomes plus one, and all of them are extremes: win, loss, and a break-even. There is no mean: you cannot win 60% or lose 50%. You either win or lose. Sometimes you get a break-even. Fundamentally, your mind constantly undergoes extremes. A break-even event has no impact: it is also an extreme, but it is just like skipping the event.

Humans are not for extreme polarities: their brains can’t sustain their impact without being strongly influenced. All successful traders know that whatever strong impact comes from the external world that the mind cannot manage consciously and decide with a free will upon it, it is a source of conditioning, which is relatively disadvantageous.

To favor your freedom from the life and death perspective, think per series of trades. It eases the process of accepting that long-lasting success comes from consistent positivity. As a result of this, you will reject risking too much in a single trade: it wouldn’t make sense to you anymore. Making it so that a trade could completely wipe out your capital or make you rich is the main reason for a life and death perspective. Moreover, it is a counterproductive attitude in both cases: even if you become rich from a single trade without “earning” it, for example, out of greed or pure luck, you can rest assured that the market will make it so that you will return every single penny. The point is that virtually every time someone risks everything in a single trade is greed or fear-backed action.

When you free yourself from the life and death perspective, you will start seeing the individual trade for what it is, and you begin to appraise the single outcome as just a part of something.

This principle is one of the big truths in life – why should trading be excluded from this?

Be nonchalant: remember that everything is just a game. At the same time, be able to manage your risk. Yes, it is a game, but would you waste thousands of hours of progress?

The psychic impact balances out

When you stop restricting your mind to a single trade and increase the number of trades that represent a sample in your perspective, the psychic impact gets smoothed.

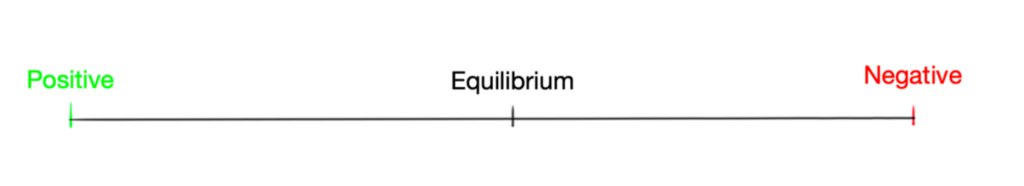

Imagine that your psychic impact is dictated by where the result of the trade is in this line below.

Positive (extreme positivity), negative (extreme negativity), and Equilibrium are the extremes. Respectively: win, loss, and break-even.

As you engage with the market trade by trade, your perspective is tied to extremes, over and over, since the result of one trade can only be one of these three possibilities.

But as you increase the number of trades in your perspective, something good happens. The result starts to consider sitting in mean points. When the number of trades in the series is more than 1, the result can sit in places different from the extremes, like 60%, 40%, 75%, etc. Now your mind is not subjected to extremes but to mean regions.

This will ease a lot of the impact that the events will have on your psyche: with a series of trades perspective, the single one will not be a question of life and death, and the result of your series, whatever number it is, would be much more psychically sustainable than the extremes of a single trade perspective.

Contrariwise to how one would think, the point of Equilibrium is not a mean point, it is an extreme. If anyone would be interested in the perfect mean, ask the ancient Greeks.

At an extreme of light, you would crave darkness. At an extreme of darkness, you would crave light. At an extreme equilibrium, you would crave nothing. If you like Earth and want to build something positive, you should consider residing in the golden mean between positivity and equilibrium.

The golden mean is the perfect seat: in it, you can create pure beauty and faultless growth. With a single trade perspective, you will only have extremes, trade by trade. With a series of trades perspective, the mean regions start to appear mathematically, and you can aspire to the path of best progress with the least strain.

Preventing the single trade expectation

Freedom from emotional vulnerability

Trading without an expectation of being right or wrong frees you from emotional vulnerability.

Without expectations, there is no risk of emotional impact and frustration or satisfaction, whereas these are things of the ego. Both positive and negative effects on the ego are detrimental for trading: the firsts unbalance the trader towards overconfidence, presumption, arrogance, and greed; the seconds unbalance the person towards insecurity, humility, despair, and fear. Both positive and negative impacts cause a distorted judgmental capability and lead to a conditioned state of mind.

When you trade with a single trade perspective, you’re making an expectation 99 times out of 100. As a matter of fact, you initiate that trade expecting that to be a profitable move. But you don’t really know if that’s the case: there is never, and there will never be a certainty. Everything can happen, even if something seems so far from reality. It’s all about probabilities.

On the other hand, when you switch your perspective to a series of trades, you are less interested in formulating an expectation. What’s the matter with how a single trade turns out? When it is not the totality of your perspective anymore, you don’t really mind. As you stop caring, you become uninterested in making an expectation from it. Why should you bother making an expectation for a single trade?

From a series of trades perspective, each trade is without any expectations. The doors of freedom open up: no emotional impact, no attachment to the outcome, no fear, no greed.

Green light to awareness of the present moment

Without expectations, there is no attachment to the future. Without attachment to the future, there is awareness of the present.

By having no expectations, one has no impulse or interest to lose his mind over his future or past, and he concentrates on living in the now, enjoying his actions. He does not expect any outcome, so he frees himself from involving the ego in his activity.

Be aware that having no expectations does not mean having no goals or aspirations. They are of a different nature. An expectation is an outcome that you focus on with the conscious mind, an aspiration is an outcome that you focus on with the unconscious.

The way the successful trader develops his trading is not with an expectation in his mind anymore. With no expectations, nothing keeps him in the future of those trades. No magnet is pulling him out of the action of trading itself. A blessing he receives: he starts to be aware of what he is doing, seeing things with new eyes, a clearer mind, and most importantly, a freer spirit. He is in the now, lives the present, and enjoys it.

A seemingly simple switch in perception and a trader can be considerably more profitable. From trading trade-by-trade to trading with a series of trades perspective. From overthinking the close picture, seeking to enjoy what did not come yet, to seeing the big picture and enjoying what’s in front of you right now.

In conclusion

A change in how you perceive your trading can revolutionize your results. In this article, we enhanced a switch from expecting to be profitable trade after trade and craving for the single outcome, to focusing on a series of trade perspective and widening up your sight.

Trading through a perception of multiple trades gives you emotional freedom upon the single trade because it stops having a life and death importance. Moreover, you lose interest in making an expectation out of it: this permits you to focus on your actions and free yourself from being stuck in your head.

Everything described in this article has the sole purpose of being informative and providing general information. The author has no intention of providing any financial advice, legal advice, or tax advice. Do not rely on this article to make investment decisions. Seek professional help before making any such decision. The author does not take any responsibility for loss or damage of any nature. The use you make of the information contained in this article is your sole responsibility.